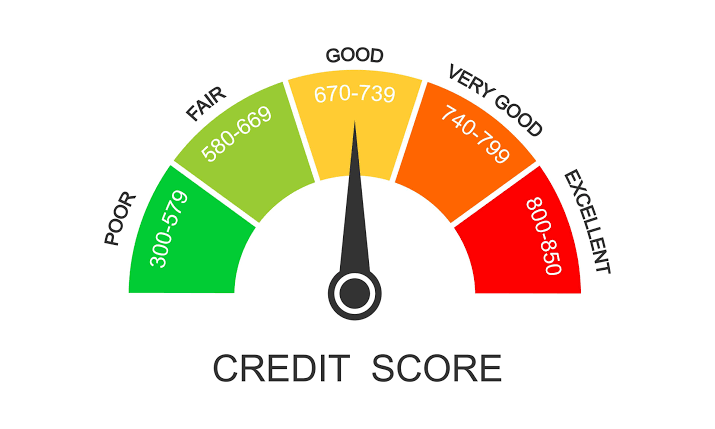

Achieving a perfect credit score remains one of the most powerful financial milestones an individual can attain. Whether measured through FICO (United States), TransUnion/Equifax (Canada), Experian (UK), CIBIL (India), CRB (Kenya), or other regional credit bureaus, a strong credit profile unlocks access to lower interest rates, higher credit limits, premium credit cards, and priority financial opportunities.

While scoring systems differ across markets, the underlying principles of creditworthiness remain universally consistent. This comprehensive 2025 guide outlines the exact steps required to build, maintain, and optimize an exceptional or even perfect credit score, regardless of your country of residence.

1. Understanding How Credit Scores Work (Global Overview)

Although scoring models vary internationally, most major bureaus evaluate similar financial behaviors. The core components typically include:

1. Payment History (35%–40%)

Timely payments remain the most influential factor. A single late payment can significantly reduce your score for months or even years.

2. Credit Utilization (20%–30%)

This refers to the percentage of your available credit currently in use. The lower, the better; most experts recommend keeping utilization below 10–20%.

3. Length of Credit History (10%–20%)

Older accounts strengthen your profile. The average age of your credit lines matters, not just your oldest account.

4. Credit Mix (10%–15%)

A combination of credit products—credit cards, installment loans, mortgages—demonstrates responsible financial behavior.

5. New Credit Inquiries (5%–10%)

Too many applications within a short period can signal risk.

2. Step-by-Step Strategy to Build a Perfect Credit Score

While perfect scores (800–850 depending on region) are rare, reaching the “excellent” category is achievable with disciplined and consistent habits.

Step 1: Establish Credit Using the Right Starter Tools

If you’re beginning from zero or rebuilding, consider:

• Secured credit cards

Deposit-backed cards approved with minimal credit history.

• Credit-builder loans

Small installment loans designed to help build a profile.

• Mobile/utility reporting programs

Some regions now allow reporting of rent, utilities, and phone payments to bureaus.

These foundational tools create the payment history essential for long-term score growth.

Step 2: Set Up Automatic Payments to Avoid Late Bills

One late payment can reduce your score by 60–120 points, depending on the bureau and history.

To avoid this:

- Enable AutoPay for all credit cards and loans

- Maintain a small emergency buffer in your bank account

- Use calendar reminders for upcoming due dates

On-time payments over a 24-month period dramatically boost scoring potential.

Step 3: Optimize Credit Utilization (Aim for 1–10%)

Credit utilization is one of the easiest yet most powerful levers.

To maintain low utilization:

- Pay your credit card twice per month

- Ask for credit limit increases every 6 months

- Spread spending across multiple cards

- Pay down balances before statement closing dates

Even if your overall usage is low, a single card with high utilization can reduce your score.

Step 4: Keep Old Accounts Open — Never Close Your Oldest Card

Length and stability of credit history significantly impact score strength.

Closing old accounts shortens your average age, which can:

- Reduce your score

- Increase your utilization ratio

- Shrink your available credit

If an old card has an annual fee, switch to a no-fee product, don’t close it.

Step 5: Maintain a Healthy Credit Mix

A perfect score profile typically includes:

- 2–4 credit cards

- 1 personal or auto loan

- A mortgage (optional but beneficial in some regions)

A diversified credit history signals that you can manage multiple types of credit responsibly.

Step 6: Limit Hard Inquiries — Apply Strategically

Each hard inquiry can drop your score by 5–10 points.

Best practices:

- Avoid back-to-back applications

- Group rate-shopping (loans, mortgages) within 14 days

- Pre-qualify with soft inquiries whenever possible

A perfect credit score often has zero to two inquiries in the last 12 months.

Step 7: Monitor Your Credit Monthly

2025 credit systems rely heavily on real-time data. Use:

- Official bureau apps

- Banking credit score dashboards

- Identity and fraud monitoring services

Frequent monitoring helps you detect inaccuracies, fraudulent accounts, or reporting delays quickly.

3. Advanced Techniques Used by People With 800+ Scores

Those who consistently achieve top-tier scores apply strategic behaviors that go beyond the basics:

A. Pre-statement payments

Paying down your card before the billing cycle closes ensures the bureau sees a near-zero utilization figure.

B. Maintaining high credit limits

Individuals with excellent credit typically request limit increases twice a year, raising their available credit without increasing debt.

C. Using multiple cards but maintaining very low balances

Perfect-score profiles often show usage of several cards without carrying month-to-month balances.

D. Avoiding co-signing

Co-signing exposes you to liabilities that can affect your score even if you don’t use the credit.

E. Disputing inaccurate entries immediately

Errors such as duplicated accounts, incorrectly reported late payments, or identity mix-ups can significantly suppress scores.

4. Expected Timeline: How Long It Takes to Reach Perfect Credit

| Starting Point | Estimated Timeline |

|---|---|

| No credit history | 12–24 months |

| Average score (650–700) | 6–12 months |

| Good score (720–760) | 3–6 months |

| Rebuilding after major issues | 12–36 months |

Consistency matters more than speed. Even a small slip—like a late payment—can reset your progress.

5. Common Mistakes That Ruin Credit Scores Worldwide

❌ Missing payments

❌ High card balances

❌ Frequent loan applications

❌ Closing old accounts

❌ Maxing out single cards

❌ Ignoring your credit reports

❌ Co-signing risky loans

❌ Falling for predatory lenders

Avoiding these missteps preserves your score and accelerates growth.

6. How to Repair Your Credit if You Already Have Problems

Rebuilding requires structured actions:

✔ Pay off overdue accounts

✔ Negotiate repayment plans

✔ Request goodwill adjustments

✔ Settle old debts cautiously

✔ Dispute inaccurate entries

✔ Rebuild with secured products

✔ Keep balances extremely low

Restoration is absolutely possible with disciplined steps.

7. Final Advice: The Blueprint for a Perfect Score

To achieve a perfect credit score in 2025:

- Pay 100% of bills on time

- Maintain 1–10% utilization

- Keep accounts open long-term

- Apply for credit sparingly

- Use a healthy mix of credit products

- Monitor your reports monthly

- Avoid financial behaviors that signal risk

Building perfect credit is not about income—it is about consistent, predictable, responsible financial behavior. Anyone, anywhere in the world, can reach the top tier with the right strategy.