A powerful deep-dive into carbon credits, how they work, how businesses profit from them, and why carbon markets are exploding globally in 2025. Learn how green finance becomes a new revenue stream for individuals and corporations.

In 2025, climate change isn’t just an environmental crisis — it’s a financial movement reshaping global economics. At the center of this shift is one of the most powerful and misunderstood tools in modern green finance: carbon credits. Once a technical term reserved for environmental economists, carbon credits are now becoming a multi-billion-dollar opportunity for businesses, governments, farmers, tech companies, and investors worldwide.

As nations push toward net-zero emissions, carbon markets have exploded, creating new demand for verified carbon reduction projects. What was once considered a slow-moving regulatory space has transformed into a fast-paced global industry where companies earn, buy, trade, or sell credits to reduce their carbon footprint — or profit from doing so.

What Exactly Are Carbon Credits?

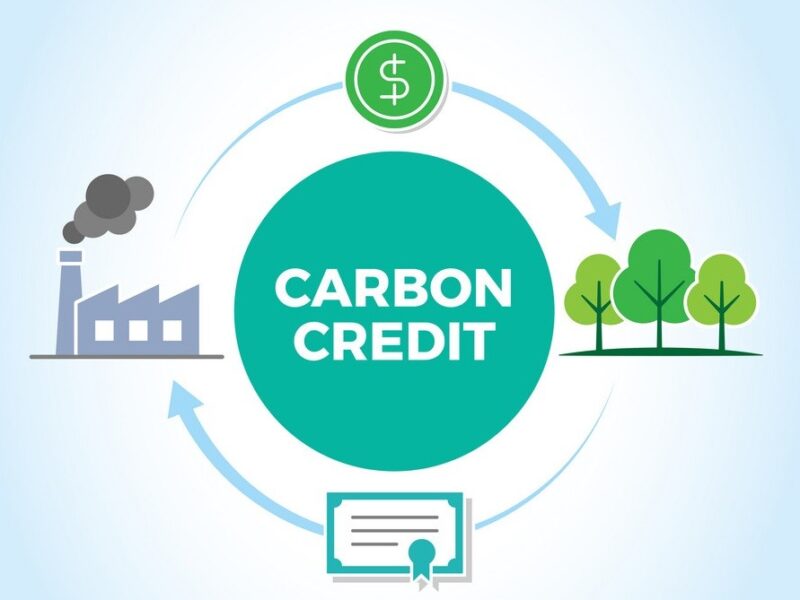

A carbon credit represents one metric ton of carbon dioxide (or its equivalent) removed or prevented from entering the atmosphere.

Businesses can generate or purchase these credits to offset their emissions. This allows companies to meet climate requirements while supporting green projects such as:

- Reforestation and afforestation

- Renewable energy installations

- Carbon capture and storage (CCS)

- Clean cooking stove distribution

- Methane reduction programs

- Soil carbon and regenerative agriculture

Each credit has measurable, verifiable environmental impact — making it one of the most trusted tools for global climate accountability.

Why Carbon Credits Are Booming in 2025

Several global factors have accelerated the carbon market’s growth:

1. Net-Zero Mandates

More than 80 countries now require emissions reporting from large companies. Non-compliance can lead to heavy penalties, making carbon credits necessary for survival.

2. Corporate Climate Commitments

Global brands — from tech giants to airlines — are publicly pledging to hit carbon-neutral targets. Carbon credits offer a strategic way to bridge the gap between current emissions and long-term climate plans.

3. Rising Carbon Prices

The price of carbon credits has surged due to increased demand and shrinking supply. Investors now see carbon markets as a new frontier of sustainable profit.

How Businesses Make Money From Carbon Credits

This is where the financial opportunity becomes massive. Companies and individuals profit in several ways:

1. Developing Carbon Projects

Organizations can create carbon reduction programs, get them verified, and sell credits on global markets.

2. Trading on Carbon Exchanges

Carbon credit exchanges allow traders to buy low and sell high, just like commodities.

3. Long-Term Carbon Asset Investing

Investors purchase credits expecting future price increases — a strategy similar to holding gold or cryptocurrency.

4. Leasing Land for Carbon Farming

Farmers and landowners can earn annual income by allowing their land to sequester carbon.

5. Selling Credits to Corporations

Corporations with emissions gaps will pay premium prices for high-quality, verified credits.

In many emerging markets, small farmers are now earning more from carbon programs than from traditional agriculture.

Types of Carbon Markets

There are two main carbon markets globally:

1. Compliance Carbon Markets (CCM)

Government-regulated markets where companies must buy credits to meet legal emission limits.

2. Voluntary Carbon Markets (VCM)

Businesses purchase credits voluntarily to meet sustainability targets, boost branding, or attract green investors.

The voluntary market has grown the fastest in recent years due to the global sustainability boom.

The Future of Carbon Credits

As climate concerns intensify, carbon credits are becoming more valuable and more limited. Experts predict that by 2030, carbon credit prices could triple, turning early participants into major beneficiaries.

In 2025, carbon credits are no longer a niche environmental concept — they are an economic engine, a business advantage, and a powerful investment opportunity reshaping how the world responds to climate change.