Emergency Mobile Loans in Kenya (2025): Instant Cash, Rates, Risks & Smart Borrowing

Discover everything about emergency mobile loans in Kenya—how they work, eligibility, interest rates, risks, and how to borrow safely. A complete 2025 expert guide.

When Money Problems Don’t Give Warnings

Emergencies don’t send calendars.

A sudden illness, school fee deadline, rent demand, power disconnection, or business cash shortfall can strike without notice. In Kenya, where many households and businesses operate on tight cash flow, such moments can quickly turn into crises.

This is where emergency mobile loans in Kenya have become a critical financial lifeline.

With just a mobile phone, Kenyans can now access instant cash—no collateral, no guarantors, no bank queues. Within minutes, funds are deposited directly into a mobile wallet or bank account.

But here’s the truth most people don’t talk about:

Emergency mobile loans can either save you or sink you.

This in-depth guide explains everything you need to know—how they work, types available, true costs, hidden risks, smart borrowing strategies, and how to use them without destroying your financial future.

What Are Emergency Mobile Loans in Kenya?

Emergency mobile loans are short-term digital credit products designed to help individuals and small businesses handle urgent, unexpected expenses.

They are accessed through:

- Mobile money platforms

- Mobile banking apps

- USSD short codes

- Digital lending applications

Unlike traditional loans, emergency mobile loans prioritize speed over paperwork.

Core Features

- Instant approval decisions

- Fast disbursement (minutes or seconds)

- No physical documentation

- No collateral requirements

- Short repayment periods

They are built for urgency—not long-term financing.

Why Emergency Mobile Loans Have Grown Rapidly in Kenya

Several factors have driven their popularity:

1. High Mobile Phone Penetration

Almost every adult Kenyan owns a mobile phone, making digital lending widely accessible.

2. Limited Access to Traditional Credit

Many Kenyans lack collateral, payslips, or formal credit histories required by banks.

3. Unpredictable Income Patterns

Informal employment and small businesses face irregular cash flow.

4. Speed Over Formality

Emergencies require immediate solutions, not long approval processes.

Common Situations Where Emergency Mobile Loans Are Used

Emergency mobile loans are commonly used for:

- Medical bills and hospital deposits

- School fees and exam registrations

- Rent and eviction prevention

- Business stock replenishment

- Utility reconnections

- Emergency travel

- Family emergencies

They are not meant for lifestyle spending, luxury items, or repeated debt cycling.

Main Types of Emergency Mobile Loans in Kenya

Understanding the types helps you choose the safest and cheapest option.

1. Mobile Network-Based Emergency Loans

These loans are offered directly through mobile money platforms in partnership with financial institutions.

How They Work

Your borrowing limit is determined by:

- Mobile money usage

- Transaction frequency

- Repayment history

Advantages

- No smartphone required

- Instant disbursement

- Simple access

Limitations

- Short repayment periods

- Penalties for late payment

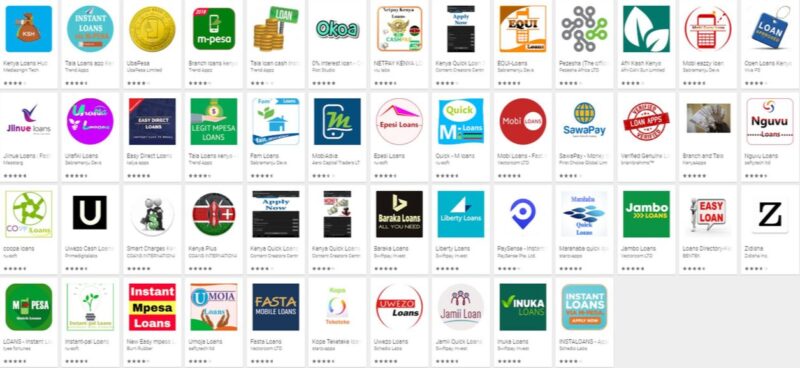

2. App-Based Emergency Mobile Loans

These are accessed through downloadable loan applications.

How Approval Is Determined

Apps analyze:

- Phone usage behavior

- Spending habits

- Digital footprint

- Repayment discipline

Strengths

- Higher limits over time

- Flexible loan tiers

Risks

- Aggressive recovery practices

- High effective interest if delayed

3. Mobile Banking Emergency Loans

Provided by licensed banks via mobile banking platforms.

Why They Stand Out

- Lower cost of borrowing

- Better consumer protection

- Clear repayment terms

Best Suited For

- Bank account holders

- Salaried individuals

- Long-term credit builders

4. Airtime and Micro Emergency Loans

Small emergency credits meant for communication continuity.

Use Cases

- Emergency calls

- Internet access during crises

Though small, they are essential in urgent moments.

Who Qualifies for Emergency Mobile Loans?

Eligibility is determined digitally.

Most lenders assess:

- Active SIM card history

- Mobile money transaction patterns

- Repayment behavior

- Identity verification

Your phone becomes your financial profile.

How Much Can You Borrow?

Emergency loan limits vary based on:

- First-time borrower status

- Repayment discipline

- Transaction consistency

Most borrowers start small and grow their limits through responsible repayment.

Interest Rates, Fees & the Real Cost of Emergency Loans

Emergency mobile loans rarely advertise traditional interest rates.

Instead, they use:

- Facilitation fees

- Access charges

- Service fees

Golden Rule

Always check the total repayment amount.

A small loan can become very expensive if fees are ignored.

Benefits of Emergency Mobile Loans

✔ Immediate access to cash

✔ No collateral required

✔ 24/7 availability

✔ Supports financial inclusion

✔ Helps prevent deeper crises

Used wisely, they can stabilize difficult situations.

Risks and Hidden Dangers

✖ High cost if rolled over

✖ Short repayment deadlines

✖ Risk of debt dependency

✖ Credit score damage if defaulted

Emergency loans are tools, not solutions to long-term financial problems.

How Emergency Mobile Loans Affect Your Credit Score

Emergency loans are reported to credit reference systems.

- On-time repayment → Positive credit history

- Late repayment → Negative impact

- Default → Long-term borrowing difficulty

Protect your credit—it determines future access to affordable loans.

Smart Borrowing Tips for Emergency Loans

- Borrow only what you urgently need

- Understand the total repayment amount

- Repay early if possible

- Avoid multiple simultaneous loans

- Use emergency loans only for emergencies

Discipline separates relief from regret.

Emergency Mobile Loans vs Other Loan Options

| Feature | Emergency Loans | Traditional Loans |

|---|---|---|

| Approval Speed | Very Fast | Slow |

| Repayment Period | Short | Longer |

| Cost | Higher | Lower |

| Paperwork | Minimal | Extensive |

| Best For | Urgent needs | Planned expenses |

The Role of Regulation in Emergency Mobile Lending

Kenya is moving toward:

- Stronger consumer protection

- Transparent pricing

- Responsible lending practices

This improves borrower safety and market stability.

Future of Emergency Mobile Loans in Kenya

Expect:

- Smarter credit scoring

- Reduced borrowing costs

- Integration with savings tools

- Stronger data protection

Digital credit is evolving toward sustainability.

QUESTIONS & ANSWERS

What are emergency mobile loans in Kenya?

Emergency mobile loans are short-term digital loans accessed via mobile phones to handle urgent financial needs without collateral or paperwork.

Are emergency mobile loans safe?

Yes, when borrowed from regulated lenders and repaid on time.

Can I get an emergency loan without internet?

Yes. USSD-based emergency loans work on basic phones.

Do emergency loans affect CRB status?

Yes. Late repayment or default negatively affects your credit record.

What is the fastest emergency loan in Kenya?

Mobile network and USSD-based loans are typically the fastest.

Use Emergency Loans as a Shield, Not a Habit

Emergency mobile loans have transformed access to instant credit in Kenya. They offer speed, convenience, and relief when life becomes unpredictable.

But speed without discipline is dangerous.

Use emergency loans strategically, repay promptly, and treat them as temporary support—not permanent income.

Borrow wisely today to protect your tomorrow.