Best Mobile Loan Apps in Kenya (2026) | Instant Cash, Easy Approval & Low Cost

Discover the top mobile loan apps in Kenya for 2026. Compare loan limits, interest, fees, repayment terms, eligibility, and how to borrow safely. A complete guide.

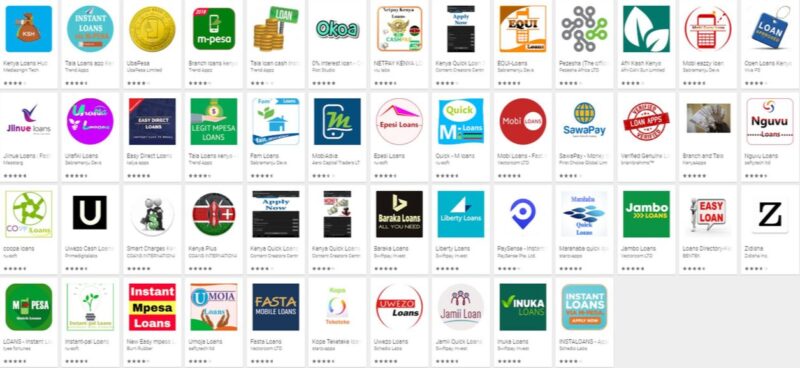

Why Mobile Loan Apps Are Transforming Credit in Kenya

In the digital age, access to credit shouldn’t be stressful — and in Kenya, it isn’t.

Today, millions of people and businesses rely on mobile loan apps to access fast, simple loans without the hassle of banks. Whether you need emergency cash for school fees, business stock, medical bills, rent, or a sudden expense, Kenya’s loan apps deliver digital credit at lightning speed — directly to your phone.

But not all loan apps are created equal.

Some offer lower fees, flexible repayment, and responsible borrowing tools. Others can be expensive or aggressive with penalties.

This guide highlights the best mobile loan apps in Kenya for 2026 — apps that are reliable, transparent, and designed to meet real borrowing needs.

Along the way, you’ll learn: ✔ How loan apps determine eligibility

✔ The true cost of borrowing

✔ Which apps have the lowest fees

✔ Smart borrowing tactics to protect your credit

✔ How to avoid debt traps

This is not just a list — it’s your practical roadmap to borrowing wisely and effectively in Kenya’s booming digital loan economy.

How Mobile Loan Apps Work in Kenya

Before diving into the best apps, it’s important to understand how mobile loan apps function:

- You Download the App or Dial a USSD Code

- The App Reviews Your Digital Footprint

- Mobile money activity

- Transaction frequency

- Spending and repayment patterns

- Phone usage and identity data

- You See Your Loan Limit

- You Apply with a Few Taps

- Instant Approval (Usually Minutes)

- Funds Sent to Your Mobile Wallet or Bank Account

- Repayment in a Set Period (Often 7–30 days)

No paperwork. No guarantors. No collateral.

But each app works a bit differently — and some are better for specific needs than others.

What Makes a Mobile Loan App Great? (Ranking Criteria)

We evaluated Kenya’s loan apps based on:

Interest & fee transparency

Loan limits & speed of disbursement

Repayment flexibility

User experience & customer support

Safety & data privacy

Regulatory compliance

Borrower protection tools

Now, let’s explore the best mobile loan apps in Kenya that deliver on these criteria.

1. Loan Smart – Quick & Reliable Emergencies

Best for: Instant emergency cash

Why It’s Top-Ranked:

Loan Smart quickly became one of the most downloaded mobile loan apps in Kenya thanks to its fast approvals, clear fees, and user-friendly design.

What Stands Out

✔ Instant funds in minutes

✔ Low minimum requirements

✔ Flexible repayment terms

✔ Transparent fees shown before borrowing

This app is ideal for first-time borrowers and those who need cash for urgent needs like school fees, medical bills, and rent.

2. FastCash Kenya – Best Overall Loan App

Best for: Balanced costs & fast service

Strengths

✔ Fast disbursement to M-Pesa or bank

✔ Competitive interest rates

✔ Multi-tier loan limits (grow with repayment history)

✔ Strong customer support

FastCash Kenya blends speed with affordability, making it a top choice for both occasional and repeat borrowers.

3. CreditGo – Best for Higher Loan Limits

Best for: Users who want larger loan amounts

Why It’s Recommended

✔ Higher initial limits (based on digital credit score)

✔ Flexible repayment windows up to 30 days

✔ Repayment history improves future limits

If you need larger amounts (e.g., business stock or school fees), CreditGo’s tiered system can give you more borrowing power — responsibly.

4. QuickLoan Hub – Best for Simple Low-Income Users

Best for: Users with limited digital credit history

Key Benefits

✔ Lower requirements for eligibility

✔ Quick disbursement without complex scoring

✔ Beginner-friendly interface

QuickLoan Hub doesn’t require an extensive digital footprint, making it a good option if you’re just building your credit profile.

5. FlexiCredit – Most Flexible Repayment Terms

Best for: Flexible repayment schedules

Unique Features

✔ Extended repayment windows

✔ Partial repayment without penalties

✔ Loan top-ups for repeat borrowers

FlexiCredit is designed for comfort. If you want breathing room with repayments, this app gives flexibility without forcing excessive penalties.

6. MobileBank Loans – Best Bank-Integrated Loan App

Best for: Users with bank accounts

Why It’s Unique

✔ Bank-secure lending

✔ Lower costs than many non-bank apps

✔ Safer, more predictable fees

If security, customer protection, and cost matter most, MobileBank Loans (through your existing bank app) is often a better choice than standalone loan apps.

7. InstantFinance – Best for Repeat Borrowers

Best for: Returning borrowers who want higher limits

Stand-Out Features

✔ Loyalty boosts your limit

✔ Better interest rates for consistent repayees

✔ Fast approvals based on profile history

For disciplined borrowers who repay on time, InstantFinance becomes cheaper and more powerful over time.

8. MicroCash Kenya – Best for Micro-Business Support

Best for: Small businesses and traders

Key Strengths

✔ Supports merchant and stock loans

✔ Flexible limits tied to earnings

✔ Business repayment support tools

MicroCash Kenya focuses on borrowers who need credit for micro-business inventory, supplies, or cash flow gaps.

Key Features to Compare Before Borrowing

| Feature | Best Loan Apps |

|---|---|

| Instant Disbursement | ✔✔✔ |

| Low Interest | ✔✔✔ (varies by app) |

| Flexible Repayment | ✔✔ |

| High Loan Limit | ✔✔ |

| Beginner Friendly | ✔✔✔ |

| Safer Bank-Linked Option | ✔ |

How Eligibility Is Determined (Without Bias)

Loan apps don’t just trust your word. They assess your digital profile using:

- Mobile money transaction history

- Spending and payment patterns

- Phone usage behavior

- Loan repayment behavior (if any)

- Identity verification (KYC)

Apps use this data to estimate your risk — and that’s why responsible repayment improves your limits over time.

Interest, Fees & the True Cost of Borrowing

Loan apps rarely show traditional “interest rates.” Instead, they charge: ✔ Access or service fees

✔ Processing charges

✔ Facilitation fees

Smart Rule

Always check the total repayment amount before you borrow.

A small loan with hidden fees can become surprisingly expensive.

Borrower Safety & Consumer Protection Tips

When using a loan app in Kenya: ✔ Never share passwords or PINs

✔ Confirm fees before accepting a loan

✔ Repay on time to protect your credit score

✔ Avoid borrowing beyond need

✔ Use reputable regulated apps

Responsible borrowing protects your financial health.

How Loan Apps Affect Your CRB Status

Loan apps report repayment behavior to credit reference bureaus (CRB).

This means:

- On-time repayment → Builds good credit

- Late repayment → Negative mark

- Default → Makes borrowing harder later

Your digital loan history becomes your financial reputation.

Smart Borrowing Strategies for 2025

- Borrow only in emergencies

- Plan your repayment schedule

- Choose apps with clear, low fees

- Repay early when possible

- Build loan limits by responsible behavior

Smart borrowing leads to bigger limits and better app trust.

Future of Mobile Loan Apps in Kenya

In 2025 and beyond, expect: ✔ Better regulation supporting safety

✔ Lower fees with competitive markets

✔ Integration with savings and insurance

✔ More transparent borrower protection rules

Digital credit is evolving towards responsible credit ecosystems.

Frequently Asked Questions (FAQ)

1. What is the best mobile loan app in Kenya?

The best app depends on your needs — but FastCash Kenya, Loan Smart, and CreditGo consistently rank high for speed, cost, and reliability.

2. Can I borrow without a smartphone?

Yes. Some apps and mobile money USSD codes allow borrowing without internet or smartphones.

3. Do loan apps affect my credit score?

Yes. On-time repayments improve your profile. Late payments can negatively impact credit.

4. Are mobile loan apps safe?

They are safe when used responsibly and when borrowing from reputable, regulated lenders.

5. How soon can I get a loan?

Most apps disburse funds within minutes after approval.

Choose Wisely, Borrow Responsibly

Mobile loan apps are transforming access to credit in Kenya. They provide fast, flexible, and often life-saving funds when emergencies strike — but they must be used wisely.

The best loan apps combine: ✔ Transparent fees

✔ Fast approvals

✔ Responsible lending practices

✔ Protection for your credit score

Download, compare, and borrow smartly — not just quickly.