The Higher Education Loans Board (HELB) has sounded an alarm over rising loan defaults, revealing that more than 250,000 Kenyans owe a staggering Sh32 billion in unpaid student loans. CEO Geoffrey Monari says this is placing significant strain on the fund’s ability to support new applicants.

Speaking during a Wednesday briefing, Monari disclosed that as of June 30, 2025, 67.5 per cent of HELB’s loan portfolio was performing, while 32.5 per cent remained at risk. “We are tackling this through employer engagement, outreach to past beneficiaries, smarter policies, and stronger accountability,” he said.

To sustain the scheme, HELB is pursuing alternative financing models, including crowdfunding and the issuance of social bonds. So far, the agency has mobilised Sh3.3 billion from 43 partners, ranging from county governments to corporate entities and development organisations.

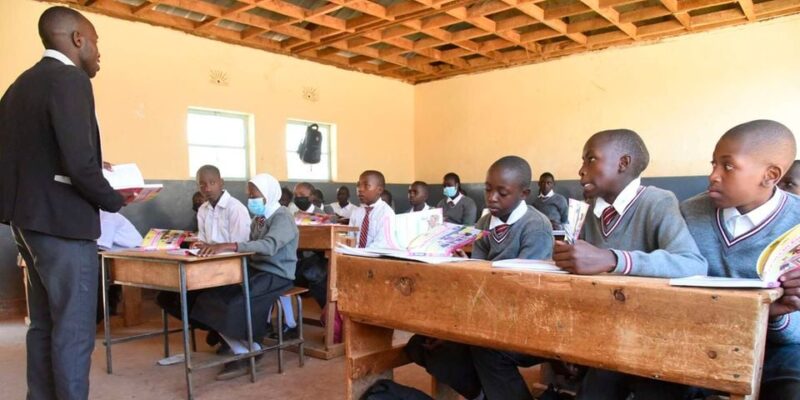

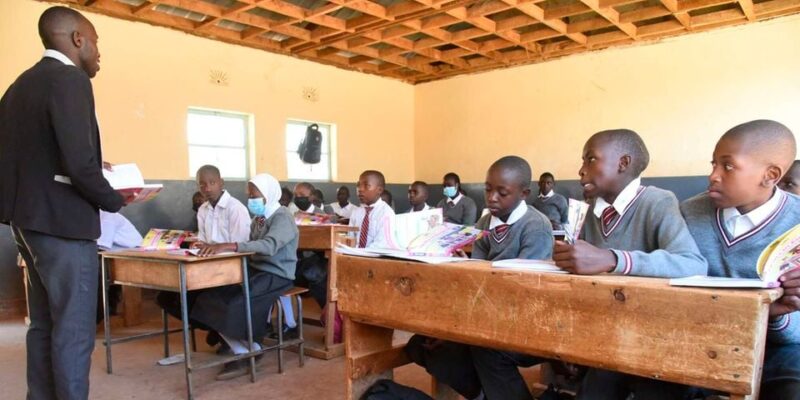

Despite the repayment crisis, the Board continues to support thousands of students. In the 2024–2025 financial year alone, HELB disbursed Sh53.4 billion, allocating Sh36.5 billion as loans and Sh16.9 billion as scholarships. By the end of June 2025, 72,000 students had received assistance.

The agency is urging defaulters to take advantage of convenient repayment methods, such as its USSD code (*642#), mobile app, self-service portal, and employer remittance channels. Through the USSD service, borrowers can check their outstanding balance, choose the amount to pay, and confirm transactions—receiving an SMS confirmation afterward. Those who clear their entire debt in a single payment qualify for an 80 per cent penalty waiver.

Monari stressed that repaying loans is more than just fulfilling a financial obligation—it is about creating opportunities for the next generation. Since launching in 1974, HELB has disbursed Sh179 billion to more than 1.7 million Kenyans.

The Board is also actively encouraging first-time and continuing students to apply for financial aid through its online portal. As of August 6, 2025, HELB had received 554,620 applications—390,499 from undergraduates and 164,121 from TVET trainees.

Monari concluded by noting that the agency is in discussions with the National Treasury and other partners to address the funding shortfall and ensure that all deserving students have access to education financing.