Foreign nationals who no longer reside in Kenya or have concluded their tax obligations in the country are required to de-register their Kenya Revenue Authority (KRA) Personal Identification Number (PIN).

The KRA has provided a clear six-step process to ensure the proper de-registration of a PIN by foreigners. This structured approach ensures that all tax liabilities are resolved and that the de-registration complies with Kenyan tax laws.

Step 1: Filing All Pending Returns

The first and most critical step in the de-registration process is to ensure that the taxpayer files all outstanding tax returns. Regardless of whether one has earned income during their stay or not, any pending filings must be addressed to maintain compliance.

KRA systems are configured to reject de-registration requests if there are unfiled returns associated with the PIN.

Step 2: Settle Outstanding Tax Liabilities

Once all pending returns have been submitted, the taxpayer must pay any due taxes. This includes any assessed taxes, penalties, or interest that may have accrued. Failure to clear these dues will halt the de-registration process, as KRA requires a clean tax record before approving any application.

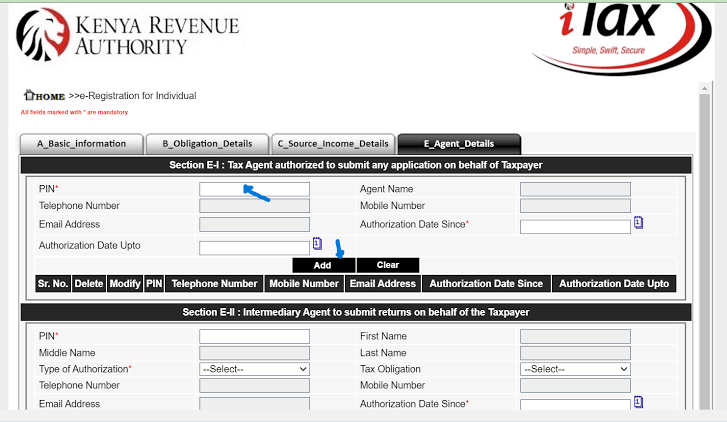

Step 3: Initiate De-registration on iTax Portal

After clearing all pending tax obligations, the taxpayer should log in to the KRA’s iTax platform to initiate the actual de-registration process. The iTax portal is KRA’s official digital system where all tax-related services are provided, including PIN registration and cancellation.

Step 4: Provide Proof of Exit from Kenya

To validate their application, the foreign taxpayer must upload evidence showing they have left the country. An endorsed passport exit stamp from immigration authorities is acceptable proof.

This requirement ensures that the taxpayer is indeed no longer physically present in Kenya and has ceased economic activity within the country.

Step 5: Submit a Sworn Affidavit

KRA also mandates that the applicant provide a sworn affidavit declaring that they do not own any property in Kenya. This step is intended to avoid future tax liabilities that may arise from ownership of assets such as land or buildings within the country.

Step 6: Application Acknowledgement

Upon successful submission of all required documents and completion of the above steps, the taxpayer receives an application acknowledgment receipt.

This receipt serves as evidence that the de-registration request has been formally submitted and is under review by KRA.

De-registering a KRA PIN as a foreigner is a legally important process that ensures clean exit and compliance with Kenyan tax laws.

Whether moving for employment, study, or personal reasons, following this six-step guide will help avoid unnecessary future complications or tax obligations. For further help, applicants can visit the KRA website or consult a tax expert.