Lending Apps With Low Interest Rates in Kenya (2026) – Affordable Digital Loans Explained

Looking for lending apps with low interest rates in Kenya? Discover affordable digital loan apps, eligibility, costs, risks, and how to borrow smart in 2025.

Why Low-Interest Lending Apps Matter in Kenya

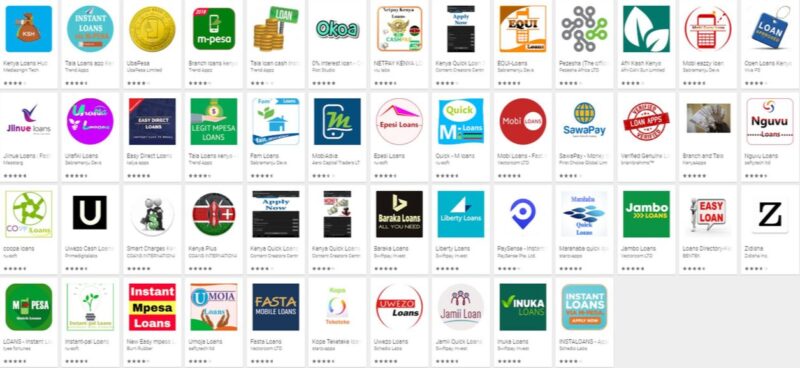

Digital lending has completely transformed how Kenyans access credit. What once required bank queues, guarantors, and paperwork can now be done in minutes using a smartphone. However, as lending apps multiplied, so did high fees, short repayment periods, and borrower frustration.

Many borrowers today are no longer asking “Where can I get a loan fast?”

They are asking a more important question:

“Which lending apps in Kenya have the lowest interest rates?”

Low-interest lending apps are critical because they:

- Reduce debt stress

- Protect credit scores

- Support sustainable borrowing

- Encourage long-term financial health

This guide breaks down how low-interest lending apps work, what makes them cheaper, who qualifies, and how to identify genuinely affordable digital loans in Kenya.

What Are Lending Apps in Kenya?

Lending apps are digital platforms that provide loans through mobile applications. They use technology to assess borrowers instantly using alternative data such as:

- Mobile money usage

- Income patterns

- Transaction history

- Repayment behavior

Unlike traditional banks, lending apps focus on speed, convenience, and accessibility.

What Does “Low Interest” Really Mean in Digital Lending?

In digital lending, interest is not always labeled as “interest.”

Instead, lenders charge:

- Facilitation fees

- Access fees

- Service charges

A low-interest lending app is one where the total repayment amount is fair and transparent, not necessarily one advertising “0% interest.”

Smart Rule

Always judge affordability by total cost of borrowing, not marketing slogans.

Why Some Lending Apps Charge Lower Interest Than Others

Several factors influence interest rates:

1. Source of Capital

Apps backed by banks or SACCOs usually charge less than purely private lenders.

2. Borrower Risk Profile

Reliable borrowers with good repayment history receive better rates.

3. Loan Purpose

Business and salary-based loans often attract lower interest.

4. Loan Duration

Longer repayment periods generally reduce monthly pressure and cost.

Main Types of Low-Interest Lending Apps in Kenya

1. Mobile Banking Lending Apps

These are operated by licensed banks.

Why They Offer Lower Interest

- Strong regulation

- Stable funding

- Risk-based pricing

Best For

- Salaried individuals

- SMEs

- Long-term borrowers

These apps combine bank-level pricing with mobile convenience.

2. Salary-Linked Lending Apps

These apps assess income stability rather than phone behavior.

Key Advantages

- Lower default risk

- Predictable repayment

- Favorable interest terms

Borrowers with consistent income enjoy some of the lowest digital loan costs.

3. Business-Focused Lending Apps

Designed for entrepreneurs and traders.

Why Rates Are Lower

- Loans generate income

- Transaction data proves business activity

These apps support Kenya’s micro-enterprise economy.

4. Regulated Digital Credit Providers

Apps operating under proper regulatory frameworks tend to be more transparent and affordable.

Benefits

- Clear pricing

- Consumer protection

- Fair recovery practices

How to Identify a Truly Low-Interest Lending App

Before borrowing, confirm:

✔ Total repayment amount

✔ Loan duration

✔ Penalties for late payment

✔ Transparency of fees

✔ Customer support availability

If fees are unclear, the loan is probably expensive.

Eligibility Requirements for Low-Interest Loan Apps

Most apps consider:

- Active SIM card

- Stable income or transactions

- Positive repayment history

- Identity verification

The better your financial behavior, the lower your cost of credit.

How Much Can You Borrow at Low Interest?

Low-interest apps often:

- Start with modest limits

- Increase limits gradually

- Reward consistency

Responsible borrowers unlock higher limits at better rates over time.

Benefits of Low-Interest Lending Apps

✔ Reduced debt pressure

✔ Easier repayment

✔ Better credit profile

✔ Long-term financial stability

✔ Suitable for repeat borrowing

Low interest means credit that helps instead of harms.

Risks to Watch Even With Low-Interest Apps

Even affordable loans can be risky if misused.

Common Mistakes

- Borrowing repeatedly

- Ignoring repayment dates

- Using loans for non-essential spending

Low interest does not remove the responsibility to repay.

Low-Interest Lending Apps vs High-Cost Digital Loans

| Feature | Low-Interest Apps | High-Cost Apps |

|---|---|---|

| Fees | Transparent | Hidden |

| Repayment | Flexible | Short |

| CRB Impact | Positive if repaid | High risk |

| Borrower Stress | Low | High |

How Low-Interest Lending Apps Affect CRB Status

Proper use improves your credit profile.

- On-time repayment → Trust score rises

- Late repayment → Negative records

- Defaults → Long-term borrowing limits

Affordable loans help build financial credibility.

Best Practices for Borrowing From Lending Apps

- Borrow with a repayment plan

- Choose longer repayment where possible

- Avoid overlapping loans

- Repay early if allowed

- Treat credit as a tool, not income

Future of Low-Interest Digital Lending in Kenya

The trend is clear:

- More regulation

- Better pricing models

- Transparent loan terms

- Consumer-focused lending

Kenya’s digital lending market is moving toward sustainability, not exploitation.

Frequently Asked Questions (FAQ)

Which lending apps have the lowest interest rates in Kenya?

Apps linked to banks, salaries, and regulated financial institutions generally offer lower rates.

Can I get a low-interest loan without a smartphone?

Some USSD-based platforms offer affordable loans without internet access.

Are low-interest lending apps safe?

Yes, when operating under Kenyan financial regulations.

Do low-interest apps affect CRB status?

Yes. Responsible repayment improves your credit score.

Can interest rates reduce over time?

Yes. Many apps reward good borrowers with better terms.

- Types of Mobile Loans in Kenya

- Emergency Mobile Loans in Kenya

- How Mobile Loans Affect CRB Status

Anchor example:

affordable mobile lending options in Kenya

Choosing the Right Low-Interest Lending App

Low-interest lending apps represent the healthy future of digital credit in Kenya. They empower borrowers, support businesses, and reduce financial stress.

The smartest borrowers do not chase speed alone—they prioritize fair pricing, transparency, and sustainability.

Borrow wisely. Repay responsibly. Build your financial future.

Tags

- Lending apps with low interest rates in Kenya, Low interest loan apps Kenya, Affordable lending apps Kenya, Digital loan apps Kenya, Online loans Kenya, Best loan apps in Kenya, Cheap mobile loans Kenya, Mobile lending apps Kenya, Low cost loans Kenya, Instant loans with low interest, Low Interest Loans Kenya, Lending Apps, Digital Credit, Online Loans, Personal Finance Kenya