Gusii Mwalimu Sacco 2026: The Definitive Blueprint for Financial Empowerment and Teachers’ Wealth

In the evolving landscape of Kenya’s cooperative movement, few institutions command as much respect and stability as Gusii Mwalimu Sacco. Originally established to serve the educational fraternity in the Gusii region, the Sacco has transcended its humble beginnings to become a multi-billion shilling financial behemoth.

As we navigate 2026, the Sacco has integrated cutting-edge fintech with traditional cooperative values, making it a premier destination for both savings and credit.

The Strategic Evolution of Gusii Mwalimu Sacco

Registered in 1977 and commencing operations in 1979, Gusii Mwalimu Sacco has survived economic shifts by maintaining a member-first philosophy. In 2026, the Sacco’s asset base has surpassed the Ksh 12 Billion mark, a testament to the trust of its over 50,000 members. This growth isn’t just about numbers; it’s about the socio-economic transformation of teachers, civil servants, and private-sector professionals who have built homes, educated children, and started businesses through the Sacco’s support.

High-Yield Savings: Building Your Financial Fortress

One of the highest CPC (Cost-Per-Click) keywords in the financial sector is “High-Yield Savings.” Gusii Mwalimu Sacco offers products that outperform traditional commercial banks.

- BOSA (Back Office Service Activity): This is the heart of the Sacco. Members contribute monthly deposits which act as collateral for loans. In 2026, these deposits earn annual dividends, often ranging between 10% and 15%, significantly higher than inflation.

- FOSA (Front Office Service Activity): Providing banking-style services, FOSA allows for salary processing, fixed deposit accounts, and children’s savings accounts.

- Holiday & School Fees Savings: Specialized accounts designed to help members plan for lumpy expenditures without falling into the debt trap.

The 2026 Loan Portfolio: Fast, Flexible, and Affordable

Gusii Mwalimu Sacco’s credit facilities are designed with the “bottom-up” economic model in mind, ensuring that even those with modest salaries can access significant capital.

1. Development & Normal Loans

These are long-term facilities, often up to 72 or 84 months, with interest rates as low as 1% per month on a reducing balance. They are ideal for land purchase, home construction, and large-scale investments.

2. Emergency & School Fees Loans

Life happens. When it does, the Sacco provides instant school fees and emergency loans processed within 24 to 48 hours. These are vital for maintaining family stability during unforeseen crises.

*3. E-Loans and Mobile Banking (879#)

In 2026, the Sacco has perfected its digital lending. By dialing *USSD 879# or using the Gusii Mwalimu Smart App, members can access “Pesa Pepe” (instant mobile loans) of up to Ksh 100,000 without visiting a branch. This digital transformation has made the Sacco a leader in the fintech-cooperative space.

Membership: Who Can Join and How?

While “Mwalimu” suggests a focus on teachers, the Sacco has opened its doors to a broader demographic:

- TSC Teachers & Secretariat: The core founding group.

- Civil Servants: Employees of various government ministries.

- Private Sector Professionals: Doctors, lawyers, and engineers.

- Business Owners: Registered SMEs and “Chamas.”

- Spouses and Children: Ensuring that financial literacy stays within the family.

Requirements for Joining:

- A copy of the National ID.

- Two passport-sized photos.

- Current pay slip (for salaried members).

- A registration fee (standardized across branches).

Welfare and Social Security: The BBF Advantage

The Burial Benevolent Fund (BBF) is a standout feature of Gusii Mwalimu Sacco. For a small monthly contribution, members and their immediate families are covered for final expenses. In 2026, the Sacco has enhanced these benefits to include comprehensive “Last Expense” packages that provide immediate cash liquidity to grieving families, ensuring a dignified send-off for loved ones.

Why Gusii Mwalimu Sacco Outshines Commercial Banks

- Lower Interest Rates: Sacco loans are generally cheaper than bank loans.

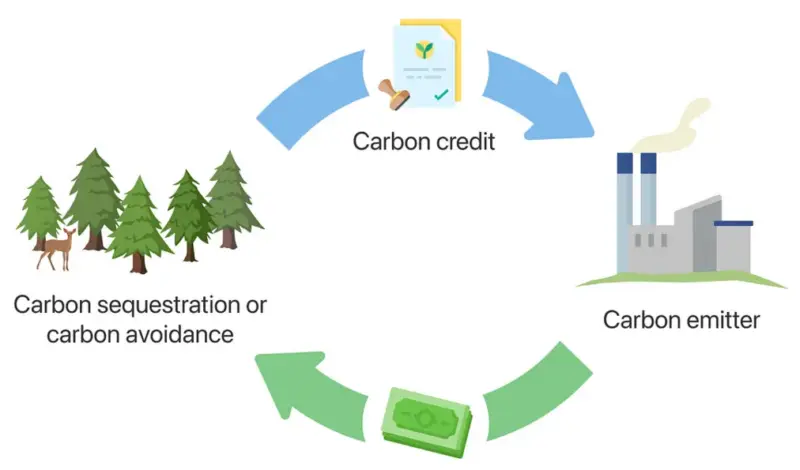

- Dividends on Savings: Banks charge you to keep your money; Saccos pay you.

- Democratic Control: Every member has a vote, regardless of their shareholding.

- Co-guarantorship: You don’t need a logbook or title deed for every loan; your colleagues can guarantee you based on their deposits.

Frequently Asked Questions (FAQs)

Q1: How do I check my Gusii Mwalimu Sacco balance on my phone? A: You can check your balance by dialing *USSD 879# or by logging into the Gusii Mwalimu Mobile App. You will need your registered phone number and a secret PIN.

Q2: What are the current dividend rates for 2025/2026? A: While rates vary based on annual performance, the Sacco has consistently paid between 11% to 14% on deposits and up to 18% on share capital in recent years.

Q3: Can I join the Sacco if I am not a teacher? A: Yes! The Sacco has expanded its common bond to include all civil servants, employees of reputable private organizations, and registered business owners.

Q4: How long does it take to process a Normal Loan? A: Once all requirements (guarantors and documentation) are met, Normal Loans are typically processed within 7 to 14 working days, while E-loans are instant.

Q5: What is the maximum loan amount I can get? A: Generally, you can borrow up to 3 times (or 4 times for specific products) your total savings, subject to the “two-thirds” rule of your net salary.